Regulatory reporting module

Streamline FATCA and CRS reporting with Bragi

Bragi’s regulatory reporting module takes the pain out of FATCA and CRS reporting. With built-in validation, simple corrections, and easy submission, you’ll stay compliant without the spreadsheet headaches.

STEP 1

Prepare

The tax reporting module exposes three custom views to the Bragi environment, covering the key elements of the submission - organisation details, client account details and controlling persons / substantive owners. Use Bragi to model source data in to the correct shape to populate these views.

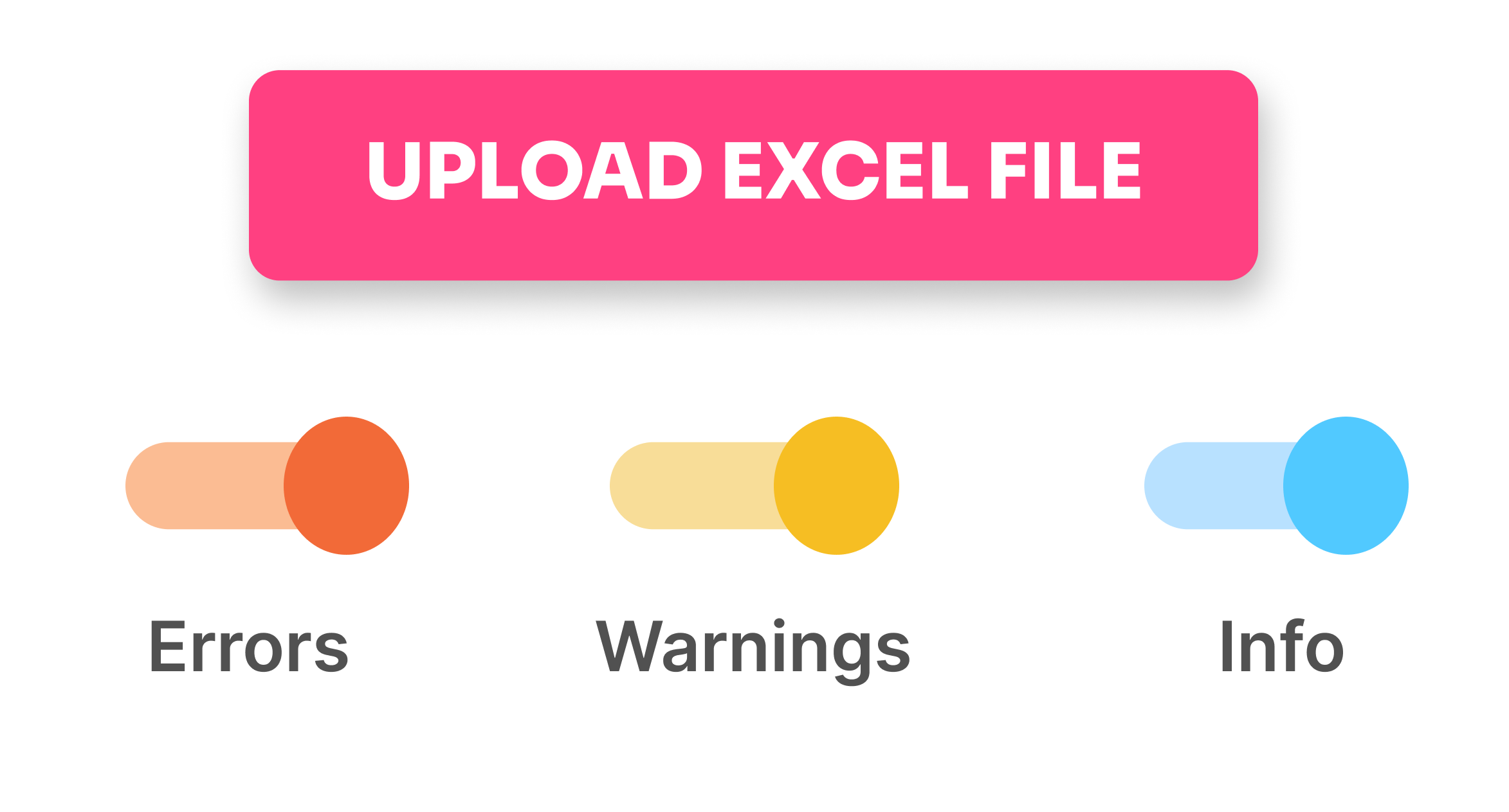

- Bespoke or adhoc reporting requirements or using data from outside Bragi? Use a pre-built Excel template to rapidly load the data in the required format.

STEP 2

Validate

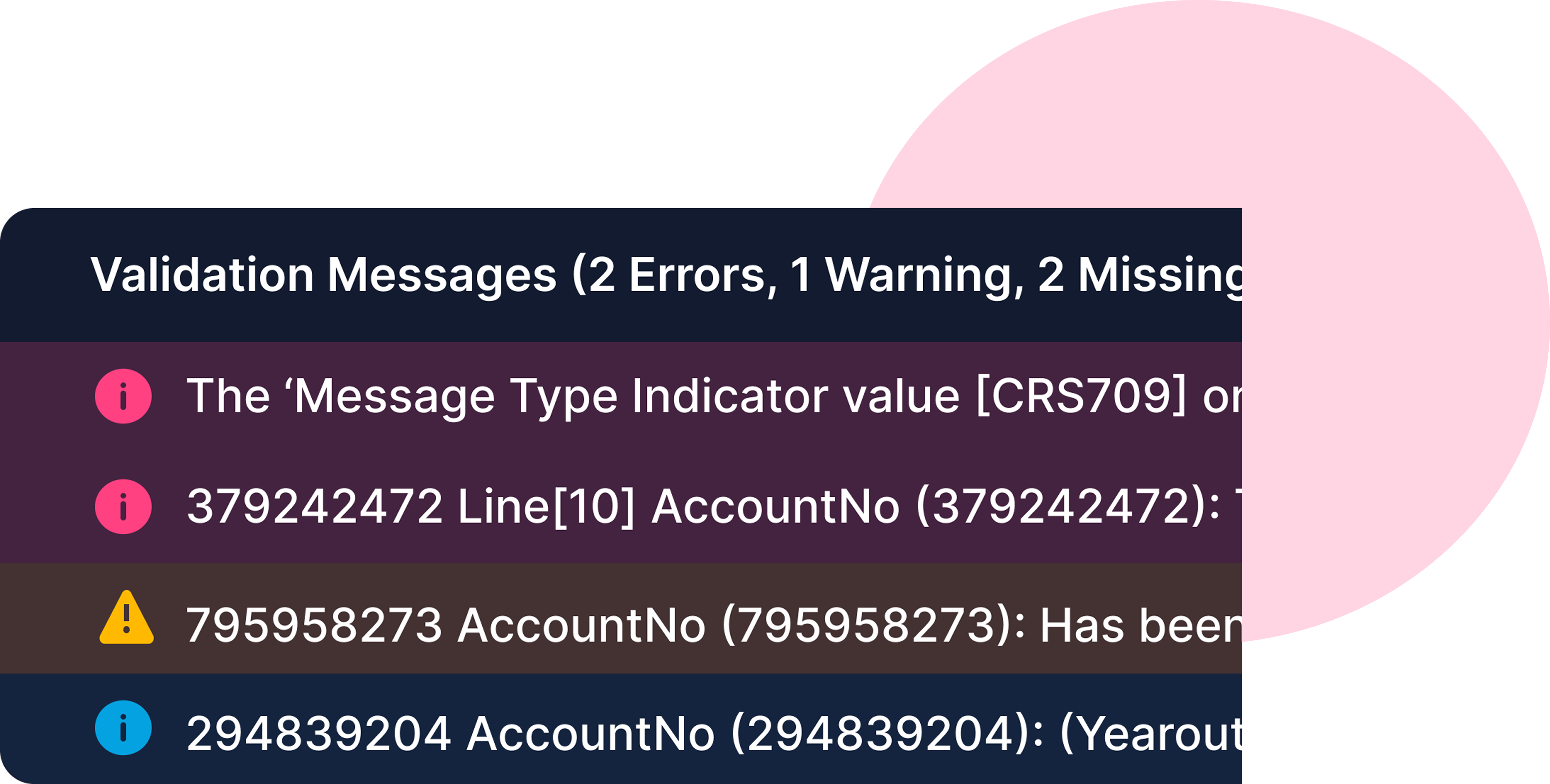

Bragi’s tax reporting module applies a suite of automatic data validations to detect errors and issues in the data based on the underlying reporting schema, including country-specific tax identification number (TIN) validation.

Any detected issues are clearly highlighted, enabling you to review and amend the data at source, iteratively preparing the submission data as many times as needed until issues are resolved.

- Build this workflow in to your client onboarding / screening processes to capture issues early.

STEP 3

Review

Bragi provides a built-in report summarising the submission data as well as full read out of accounts that will be included.

Use this report to perform any final checks.

STEP 4

Submit

Depending on the recipient tax portal, either submit directly using their API from within Bragi, or download a submission XML document and submit manually. Either way, the submission is guaranteed to be schema-compliant. Recipient jurisdictions with custom requirements (such as as encryption, ZIP packaging) are also supported.

"By utilising the TIN validation feature, we have been able to pre-validate our submissions greatly reducing the likelihood of corrections or resubmissions in the future, resulting in significant time savings. The ease of uploading pre-mapped templates has greatly simplified the process and the jurisdiction-specific XML output is consistently updated to meet the latest requirements, making it a dependable tool for our business needs. We will continue working with Cortex as a client-focused partner."

Learn more about Bragi

Learn more about FATCA and CRS reporting in Bragi

Speak directly to Bragi’s co-founders, not a sales agent, and explore how Bragi can transform your data workflows.

How do we make submissions to the receiving tax portal?

+Can I create correcting submissions?

+Can I import data from previous submissions?

+Is the reporting module only available through Bragi?

+Bragi’s regulatory reporting module is designed to be integrated to create a seamless experience. However it is possible to use the module in a standalone configuration on our SaaS platform in the cloud.

Please contact us for more details or to discuss your requirements.